[Updated June 16, 2023]

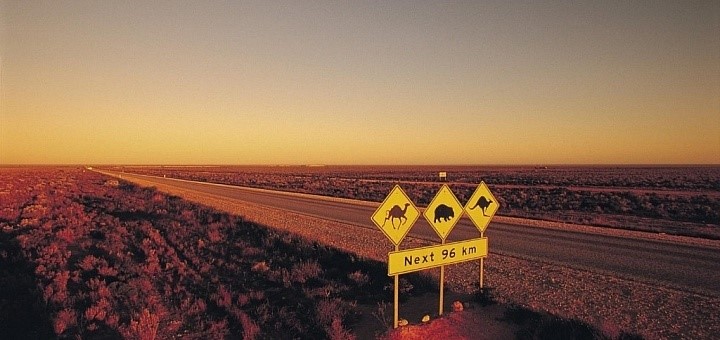

People, who live in remote areas of Australia, can have a tax concession offset, and this is referred to as Zone Tax Offset. The purpose of this offset is to help with the high cost of living and other environmental factors associated with living in remote area. If you are entitled to claim such offset, it could considerably help you maximise your tax refund.

Who is eligible?

The government defines remote areas as a Zoned Area, e.g. Zone A, Zone B or Special Area, you can check on this link to the ATO page to see if you are in a Zone Area.

If you live in a zoned area, you may be entitled to claim the zone tax offset.

To be eligible for the zone tax offset, your usual place of residence must be in a zoned region. However, people who work but do not live in a zoned area, are not eligible.

183 Day Threshold

In most cases, you have to live in a zone area for more than 183 days of the year to claim the zone tax offset. However, if you live in a zone area for less than 183 days, you may still be able to claim the tax offset if your place of residence was usually in a zone for a consecutive period of less than five years and:

- You were unable to claim the tax offset in the first year because you lived there less than 183 days

- The total of the days you lived there in the first year and the current income year is 183 or more. The period you lived in a zone in the current income year must include the first day of the income year.

How much can you claim?

The value of zone tax offset for single person for a year is different between each zone:

- Zone A: $338

- Zone B: $57

- Special zone areas: $1,173

Australian Defence Force

For Australian Defence Force’s member, you may be qualified to claim Overseas Forces Offset or Overseas Forces Tax Exemption. In some cases, you can be qualified for both zone offset and overseas forces offset, but ATO only allows you to claim one of the. Therefore, it is recommended you research about each offset or simply contact us and choose the highest offset.

Have any more questions? You can contact us by calling 1300 698 297 or emailing info@mytaxrefundtoday.com.au.